Jeff writes:

“I actually love my job, but full time is getting pretty tough, I have heard I can retire and continue working part time? What’s up with that? It would be perfect. Tell me something so I don’t sound stupid when I ask my super.”

Jeff D. USPS

Jeff, there is a plan, if your agency will go for it, the program is called Phased Retirement, it works this way: You must be eligible to retire at your MRA with at least 30 years of service or age 60 with 20 years of service. In other words, you can fully retire, however, you want to continue working. Your agency must offer it to eligible employees. If your agency is interested in Phased Retirement, usually an offer is made via bulletin.

The qualifying employees may submit applications during that window and management then considers whether to approve them..

With only very limited exceptions, phased retirees must spend at least a fifth of their working time mentoring co-workers.

- The underlying law allows the working time portion to range from 20 to 80 percent, on average from one to four days per week; the percentage could not change during the phased retirement period, even if the individual switched to another job. However, the Office of Personnel Management has determined as a matter of policy that at least for an initial period—how long is undefined—the only allowable split will be half-time work.

- While employed, phased retirees fall under the standard benefits policies applying to active employees, with some special considerations. (Note: Entry into phased retirement is not a “qualifying life event” that conveys eligibility to make certain changes in some insurance benefit.)

- Federal Employees Health Benefits Program and Federal Employees’ Group Life Insurance benefits are provided through the employing agency, under the terms of the job, not under terms applying to retirees. FEGLI benefit coverage amounts are based on the full-time salary rate for the position even though the employee is working only part time, and the government payment toward FEGLI Basic continues.

- Phased retirees continue to earn annual and sick leave, prorated according to their work schedule as with part-time employees in general. Thus, they will earn leave at only half the rate they did as full-time employees. The “use or lose” annual leave ceiling, typically 240 hours maximum to carry from one leave year to the next, is unaffected.

- Phased retirees do not receive a lump-sum payment for unused annual leave (as do regular retirees) since they are not separating from service.

- Full Retirement—A phased retiree may retire completely at any time without agency permission. At that time, the full annuity will be paid, including an increase reflecting the time worked as a phased retiree and applicable credit for unused sick leave.

* Part-Time Service—Under CSRS/CSRS Offset and FERS, retirement benefits for part-time service are prorated. The high-3 average salary used is the salary that would have been paid if the employee had worked full time, and the basic benefit calculation is the same. However, the service time credited for part-time work is calculated according to the time actually worked.

• Unused Sick Leave—Unused sick leave cannot be credited as time served for retirement eligibility purposes. However, it is creditable in the calculation of the benefit; for technical reasons, the conversion formula gives a day’s credit for about six hours of unused sick leave, rather than eight. That translates into a month of credit for every 174 hours of sick leave.

• Owed Deposits and Redeposits—Employees may pay a deposit to capture service credit for time worked for which no retirement contributions were withheld, or for which contributions were withdrawn at a break in service and not previously repaid.

• Military Service—Employees similarly may pay a deposit to capture service credit for military service time within certain restrictions.

The computation of a phased retirement annuity comes with these special considerations:

• Service Requirement—In order to participate in phased retirement, an individual must have been employed on a full-time basis for the preceding three years.

• Sick Leave—No unused sick leave can be used in the computation of the phased retirement annuity. It is included in the add-on annuity computed at full retirement in the same way as for a person retiring from a full-time position.

• Deposits-Any deposits and redeposits required to capture credit for service time, including for military service, generally must be made prior to entry into phased retirement status. The exception is if a phased retiree switches to full-time federal employment; in that case, needed payments must only be made before full retirement in order to capture that time.

• Survivor Benefits—A survivor benefit election cannot be made on a phased retirement annuity. Rather, the individual is treated as an employee for death benefits purposes. After full retirement at the end of phased retirement, a survivor annuity election can be made under the same rules that apply to standard retirement.

• Death in Service—Upon a death of an individual in phased retirement status, the period of phased retirement will be treated as a period of part-time service in the computation of the survivor annuity. The survivor can make any needed deposits or redeposits to capture credit for the employee’s service time on the same basis as if the decedent had not been a phased retiree. A FERS employee basic death benefit will be based on the full-time salary rate of the position.

• Court Orders—Phased retirement annuities are subject to court orders providing for division, allotment, assignment, execution, levy, attachment, garnishment, or other legal process on the same basis as other annuities. Phased retirees’ pay from their employment is subject to garnishment and other legal process on the same basis as other federal employee pay.

• Special Retirement Supplement—Those taking phased retirement under FERS are not eligible for the Special Retirement Supplement, which is a monthly payment ordinarily available to those who retire before age 62 that duplicates the value of a Social Security benefit earned while a federal employee and is paid up to age 62 when normal eligibility to draw benefits from that program begins.

At entry into phased retirement, the employee’s earned annuity will be computed and then divided by two. The half annuity will be paid while the individual works a half time schedule receiving half pay of the position.

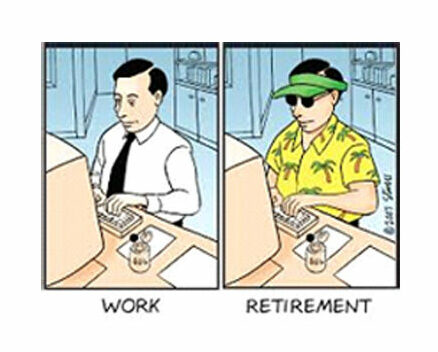

In my opinion, this little know benefit can serve many who are not ready to give up the ship, but do not want or cannot work the grueling hours required in full time employment.