If we know a fund will decline, we are likely to move to a fund which is not losing. Right? This makes sense, but what is confusing to many is the timing of the move to a different funds. The advice most headed is put it away and forget it. This may not be a bad strategy looking decades ahead, but when months or only a few years before retirement a loss could be a delayed retirement. IN 2000 crash and 2008, many employees postponed retirement for several years, because of the terrible losses in their TSP. So, how do we know when it is time to move from one fund to another? In a word: ‘TREND’

Watching an index such as the S&P or the DOW will tell you how the economy is moving, does it look like it is gaining or losing? Trend.

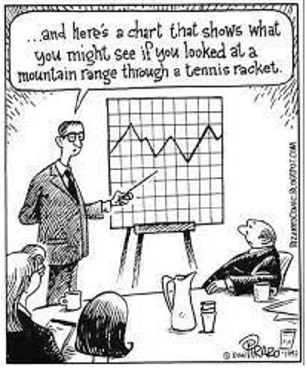

Let’s look closer. A trend is the overall direction of a market or an asset’s price. In technical analysis, trends are identified by trendlines or price action that highlight when the price is making higher swing highs and higher swing lows for an uptrend, or lower swing lows and lower swing highs for a downtrend. Understanding this natural movement, like watching for a rainy day, take your financial umbrella with you when the trend is not the smooth uptrend. Today, we are not on a smooth upward, but an erratic downtrend. When we see upward, and we can ride that wave, it is helpful to your fund to begin upward from the higher position, rather than gain back what you have lost.

How long to watch and establish a trend?

In the world of your life savings, the longer the better, but 3 months should point to a future of gains or losses. If things move fast, you might think you are losing money, but as you near retirement a paradigm shift should occur, that being from one of gains to one of preservation.

After all, like the guy said: ‘a penny saved is a penny earned”